DAWN OF SAMSUNG BRINGS MORE CHANGES Zoning alterations, multiple land deals and higher water rates part of picture

BY SUZANNE STEVENS

TAYLOR — A flurry of land deals, zoning changes, meteoric growth and higher water rates for residents are all in the cards now and beyond as Samsung Austin Semiconductor prepares to go online next year.

Though the announcement of the technological behemoth’s arrival was made less than two years ago, the giant plant rising from a sea of cranes southwest of downtown continues to drive more and more of the city’s deliberations.

At a July City Council meeting, officials said next year’s total budget of just under $62 million is $14 million more than last year. As the city’s expansion continues, reports show residential property values are down, although still high as far as some are concerned, and taxes are going up.

According to the city, new residential improvements have been steadily rising since 2020 and showing no sign of slowing, with an additional 82 projects announced this past year alone.

Meanwhile, Samsung — which, in essence, is spurring much of that development — is sparing no expense to establish its massive facility.

The company — owned by the South Korean multinational Samsung Electronics Corp. Ltd. — is developing a 6-million-square-foot facility with an estimated $25 billion being spent upon completion.

The plant will be operational in 2024. Over time, thousands of new employees will work there, in addition to droves of temporary workers tied to construction and ancillary businesses.

An earlier Samsung plant built in the 1990s remains operational in nearby Austin.

Offsetting some of the costs for the Taylor site are the huge tax incentives and write-offs promised to the company by Taylor and Williamson County leaders totaling $954 million over the life of the agreement.

Those measures have forever changed Taylors’ physical and economic landscapes.

Multimillion-dollar land deals are now the norm as limited liability corporations from far and wide swoop in to gobble up land for development. Some are new subdivisions; others are home to Samsung’s suppliers.

One such deal was taken up at the July council meeting in which the preliminary budget was discussed.

LAND DEALS

During that session, Assistant City Manager Tom Yantis requested that parts of three parcels consisting of 56 acres at the corner of Wesley Miller Lane and FM 973 be changed into a growth sector in the city’s comprehensive plan.

After his presentation, the council unanimously approved the initiative. The land is located near Samsung and properties owned by the Taylor Independent School District, including the high school.

Texas Multifamily Capital LLC wants to develop the area, but parts of it were considered “limited growth” because of a “lack of utilities” in the area, according to Yantis.

Though sparsely populated, homes there already utilize private wells or water from Manville Water Supply Corp. in Coupland. But property boundaries, rules governing the city’s extraterritorial jurisdiction and a lack of water have made it difficult for some residents to get Manville service.

And, without a stable source of water, it’s hard to build.

So, what changed? Yantis said the water and sewer lines built for Samsung can now service that area.

“The lines will have excess capacity after Samsung’s peak usage, which will be available to other properties in the area,” Yantis said.

It’s estimated the Samsung plant will need as many as 14 million gallons of water per day.

That water will come from EPCOR utilities in Milam County. EPCOR, originally the Edmonton Power Corp., is a Canada-based provider of water and electricity.

During an initial press conference after the Samsung deal was announced in November 2021, Williamson County Judge Bill Gravell said Samsung “would sell” any excess water.

Meanwhile, Yantis’ office said the city has no plans to purchase water from Samsung at this time.

Even so, residents could still end up paying for it — one way or the other.

WATER RATES

Remember the city budget?

Jeff Wood, the city’s chief financial officer, said residents will see an 8% increase in the water-usage tax in 2024 because of Samsung.

“To treat their wastewater and to provide them with water ... (our) prices go up or we have to purchase more water to meet their demands,” Wood said.

This could end up being a sore subject for some residents, many of whom showed up at previous council meetings concerned about Samsung’s water needs becoming a drain on their pocketbooks or the system.

In fact, that was one of the reasons Samsung said it decided to go with EPCOR utilities because Taylor could not supply it with what it needed, yet Taylor had to “purchase more water,” according to Wood.

In the fiscal year 2023 budget there was a 10% increase in the same tax and additional 8% increase in sewer tax.

HOUSING PLANS

Texas Multifamily has plans for “missing-middle” housing, formerly known as low-cost housing, coupled with shops.

During a June 22 public meeting, Chris Bancroft, a representative for Texas Multifamily Capital, said the goal is to “develop a unique and high-quality, lowdensity rental product that would stand out from conventional multifamily.”

He also added that this “missingmiddle housing” would generate about $24,000 an acre in annual property and sales taxes.

Texas Multifamily purchased the 56 acres in April 2022; it was valued at $3.5 million this year.

It’s worth mentioning that back in May, Taylor ISD paid close to $4.4 million for 37 acres for a planned campus next door to the Texas Multifamily development.

It’s unclear why there is a discrepancy in price per acre in the two separate properties given their nearness to each other.

The sales agreement does mention Taylor ISD can adjust the purchase price to align with market value, but this is where matters stand right now.

Price isn’t the only difference between the two properties; the school district parcels will not be utilizing Samsung water and sewer lines.

Conor Stuart from the city’s engineering firm HDR said water for this property would most likely “tie into existing lines around Taylor High School” and sewer lines would likely “follow the existing grade to the northeast of the property.”

The money spent here was part of a voter-approved bond issue that set aside $7 million for land acquisitions only.

There is more development afoot, in part spurred by the fact that Samsung will be attracting thousands of full-time and temporary workers to the area over the next few years.

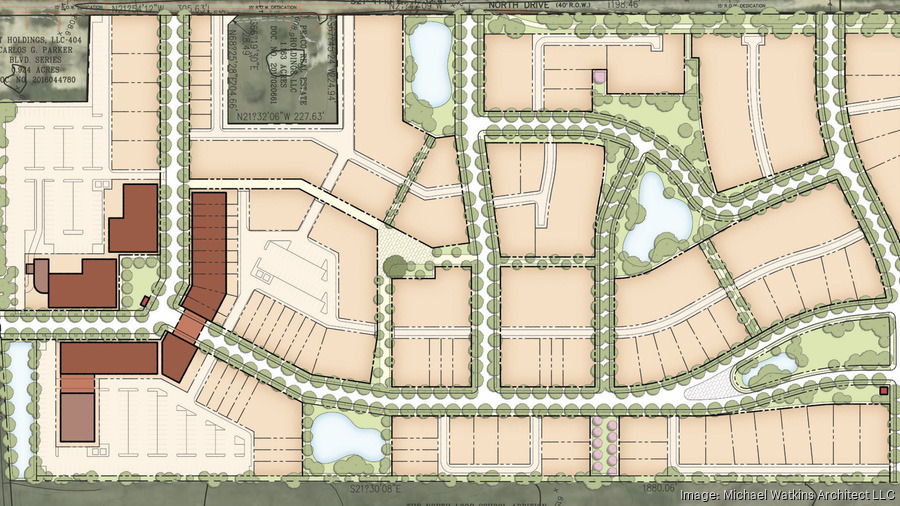

Taylor-based EVC Homes LLC — owned by married couple Geraldo Reyes, a Taylor native, and Elizabeth Krueger — hopes to build a 40-acre subdivision on the northern edge of Taylor called North Village.

The development features singlefamily homes, fourplexes, townhouses and cottages for purchase.

North Village is planned as a walkable neighborhood, with pedestrian-only pathways that cut across the community and lead to the adjacent Taylor Middle School.

Reyes says they have set aside 10 acres for commercial development with the potential for a hotel somewhere on the site.

The first phase of construction could begin in January 2024 with the commercial aspects of the development not expected until the final phase.

EVC owns an additional 98 acres at the northern edge of North Village, according to Williamson Central Appraisal District records.

At this time there are no plans to develop that land, according to Krueger.

An additional two developments reviewed by the city’s Planning and Zoning Commission were adopted by the council in July.

The first project is a 15-acre development called Legacy Crossing, owned by Plutus Austin LLC.

It straddles Debus Drive and Sloane Street and was rezoned from single-family residential to planned development.

Legacy will consist of nine singlefamily detached homes, 74 single-family attached homes and 16 fourplex units.

The second project is called Gateway, owned by Gateway Oz Real Estate LP. It will be situated on a 37.7-acre tract off U.S. 79, about 2 miles north of the Samsung site.

That land was zoned for ruralagriculture and single-family development but rezoned to a commercial planned development with residential and commercial base zoning districts.

Public records show that 347 residential units are planned to include townhomes, apartments, residentialover-retail

properties and live-work

residences.

It could also incorporate some 76,000 square feet of retail space.

The company lists Gateway Gp LLC as its registered agent. Attempts to contact them were unsuccessful.

However, part of the name does shed some light.

Oz, also known as Opportunity Zones, is an economic development tool that allows people to invest in distressed areas in the Unites States.

The IRS says the purpose is to spur economic growth, while providing tax benefits to investors.

OPPORTUNITIES

Yes, opportunities are ripe in Taylor right now.

When Samsung goes online during the second half of 2024, it expects to hire 2,000 employees.

If all goes well, another nine manufacturing facilities plants will be built at the Taylor site over the coming years, with the potential of adding 10,000 new jobs.

Those workers are going to need places to live, eat and to visit, planners say.

More developments are in the pipeline.

At the end of a July council meeting, city leaders retired to a closed-door executive meeting to hear a proposal from Taylor FM 973 LLC, which owns several plots of land in Taylor.

One thing is clear — Taylor’s growth shows no signs of slowing down, officials said.

“Prices go up or we have to purchase more water to meet their demands.”

— JEFF WOOD

Taylor chief financial officer

Comment

Comments